What if you could grow a modest Forex account into something substantial over time—without increasing your risk? Welcome to the world of Forex Compounding, a powerful strategy that has transformed the way many traders approach long-term growth.

In traditional finance, compounding refers to reinvesting profits so they themselves begin to earn returns. This snowball effect has made countless investors wealthy over time. In the Forex market, where traders deal with pips and leverage daily, compounding can exponentially grow trading accounts if used with discipline and a sound strategy.

This article will guide you through the concept of Forex Compounding, explore why it’s so effective, and provide real-world techniques and examples that can help you turn small, consistent gains into lasting wealth.

What Is Forex Compounding?

Forex Compounding is the process of reinvesting profits from your trades to increase the size of your future positions. Rather than withdrawing gains, you add them to your capital base, allowing each subsequent trade to be slightly larger. Over time, this creates exponential account growth.

At its core, compounding in Forex works similarly to compound interest in savings:

$A = P (1 + r)^n$

A = Future Account Balance

P = Starting Capital

r = Rate of Return per Period

n = Number of Periods

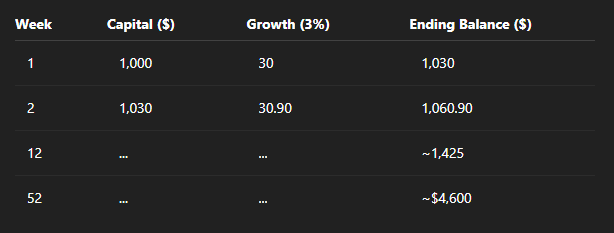

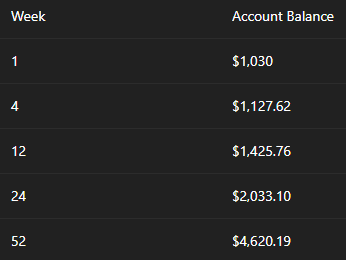

For example, if you grow your account by 3% per week, your profits each week are based not only on your original capital but also on the profits from previous weeks.

Forex Compounding relies heavily on:

- Consistent gains (even if small)

- Proper lot sizing based on account size

- Sound risk management to avoid drawdowns that ruin the compounding effect

Why Compounding Works in Forex Trading

Unlike gambling or speculative investing, compounding in Forex takes advantage of:

Consistent Small Gains

Making 2–5% per week may seem small, but when compounded, these returns can grow dramatically over time. For example:

Psychological Benefits

Watching your account grow steadily helps build confidence and patience. It shifts your focus from “winning big” to “winning consistently.”

Long-Term Focus

Traders who compound adopt a long-term view. Instead of daily wins or losses, the priority becomes equity growth month over month.

Compounding vs. Static Growth

With static trading, you might always risk the same $50 per trade, earning linear returns. With compounding, your returns increase alongside your capital base, offering exponential growth.

Forex Compounding Techniques You Should Know

There are several methods traders use to implement compounding strategies:

Daily Compounding

Profits are added to capital daily, and each new position reflects the increased equity. Works well for high-frequency traders.

- Pros: Fastest growth, momentum-based

- Cons: Requires consistency and time commitment

Weekly or Monthly Compounding

Traders calculate profits at the end of each week or month and adjust position size accordingly.

- Pros: Easier to manage, good for swing traders

- Cons: Slower than daily compounding

Percentage-Based Position Sizing

This involves risking a fixed percentage of your account on each trade, commonly 1–2%.

- Pros: Built-in risk control, scales naturally

- Cons: May limit growth if too conservative

Lot Increments

Traders increase lot sizes manually after certain profit milestones.

- Pros: Controlled growth

- Cons: Requires tracking and manual updates

Example: How Forex Compounding Grows a Small Account

Let’s say you start with $1,000 and aim for 3% weekly growth using Forex Compounding:

In just one year, your account grows over 4.6x its original size. And this is without adding more capital—just letting compounding do the work.

This is the power of slow, consistent growth using sound strategies.

Tools and Calculators for Forex Compounding

To implement Forex Compounding effectively, here are some handy tools:

- Online Compounding Calculators

Websites like MyFxBook or Forex21 offer free calculators where you input starting capital, expected return, and time frame. - Excel Templates

Custom Excel sheets help track weekly performance, adjust lot sizes, and simulate different compounding scenarios. - Trading Journals

Use journals like Edgewonk or TraderSync to track metrics, review trade performance, and support your compounding plan. - Broker Tools

Some brokers offer equity growth charts and risk calculators. MT4/MT5 also support custom scripts and EA tools to automate tracking.

Common Mistakes in Forex Compounding

Forex Compounding is powerful, but only when executed wisely. Avoid these pitfalls:

- Overleveraging

Traders often get greedy and increase lot sizes too aggressively, which leads to large drawdowns. - Ignoring Risk/Reward Ratios

Consistently risking more than you can afford to lose breaks the compounding cycle. - Inconsistent Strategy

Random trade sizes, changing strategies, and emotional trading kill consistency—which compounding thrives on. - Neglecting Losses

Failing to adjust your position sizes after losses can distort compounding progress.

Best Practices for Successful Forex Compounding

Here are key principles to ensure success:

- Set Realistic Profit Targets

2–5% per week is achievable for disciplined traders. Avoid chasing double-digit gains. - Stick to Your Plan

Don’t abandon your system after a few losses. Compounding is about consistency over time. - Manage Risk Properly

Use stop-losses and never risk more than a fixed percentage of capital per trade. - Review and Adjust

Check your performance monthly. Are you hitting your targets? If not, refine your strategy. - Withdraw or Reinvest Strategically

Some traders prefer to withdraw profits quarterly; others compound continuously. Choose what works best for your goals.

Is Forex Compounding Right for You?

Ideal for:

- Traders with patience and discipline

- Those seeking long-term growth rather than fast profits

- Traders who can stick to a defined plan

Not Ideal for:

- Impulsive or high-frequency gamblers

- Traders looking for instant wealth

- Those unwilling to track performance

Ask yourself: Are you okay with small wins that grow over time? If yes, Forex Compounding could be your path to steady success.

Conclusion

Forex Compounding is not a get-rich-quick scheme, but a proven path to exponential account growth through consistent gains and discipline. By reinvesting your profits and managing risk wisely, you allow your capital to grow on itself—turning pips into real profits over time.

Start small, stay consistent, and let the power of compounding do its magic.

Ready to get started? Try out a Forex Compounding Calculator today and take control of your financial growth journey.

FAQs

Q: How does compounding differ from standard trading?

A: Standard trading involves withdrawing or not reinvesting profits, leading to linear growth. Compounding reinvests gains for exponential growth.

Q: Can compounding work with automated trading?

A: Yes, expert advisors (EAs) and bots can be programmed with compounding logic.

Q: Is compounding risky?

A: Only if you overleverage or lack a consistent strategy. When managed well, it’s one of the safest ways to grow capital steadily.