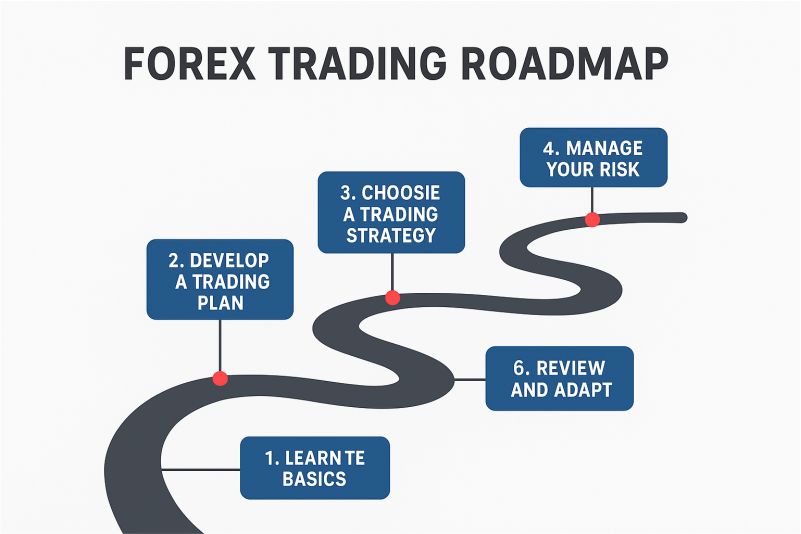

Most traders create a trading plan when they first start their journey—but only a few actually review it regularly. Yet, consistent review is the foundation of continuous improvement. Without it, you risk repeating the same mistakes, missing opportunities, and losing sight of your goals.

In this guide, we’ll walk you through how to review a trading plan effectively, the right timing to do it, and the key steps that separate disciplined traders from those who trade on impulse.

Why Reviewing Your Trading Plan Matters

Your trading plan is like a roadmap—it outlines your strategy, risk management rules, and decision-making framework. But the market is never static. It evolves as volatility, liquidity, and sentiment shift.

If you never revisit your trading plan, it can quickly become outdated or misaligned with current conditions. Reviewing your plan allows you to:

- Measure progress toward your trading goals.

- Identify patterns of mistakes or success in your trading behavior.

- Adjust strategies to fit current market environments.

- Improve discipline and accountability through reflection.

In essence, reviewing your trading plan keeps you adaptive, self-aware, and consistent—three traits that define professional traders.

When Should You Review Your Trading Plan?

There’s no one-size-fits-all frequency, but most experienced traders follow a consistent review schedule. Here are three common approaches:

- Weekly Review – Ideal for active traders. Helps track short-term performance and emotional patterns.

- Monthly Review – Best for swing traders or part-time traders who focus on broader performance trends.

- Post-Series Review – Review after every 10–20 trades, regardless of time. This allows for pattern recognition and performance benchmarking.

Pro tip: Don’t wait until you’re in a losing streak. The best traders review both their winning and losing periods—because each provides different insights.

Step-by-Step Guide to Reviewing a Trading Plan

Step 1: Gather Your Trading Data

Before analyzing anything, you need accurate data. This includes:

- Your trade journal (entry/exit points, lot size, P/L per trade).

- Screenshots of your trade setups.

- Notes about your emotional state during trading.

- Performance summaries from your broker or trading platform.

Make sure your journal captures both quantitative data (numbers, results) and qualitative data (thoughts, reasons, emotions).

The combination of both is essential for deep insight.

Step 2: Review Your Goals and Strategy

Your trading goals act as the compass for your plan. Ask yourself:

- Are my goals still realistic and measurable?

- Am I achieving consistent progress toward them?

- Has my strategy produced the results I expected?

If you notice your goals are too vague (“make more money”) or your strategy isn’t delivering, it’s time to refine them.

A good goal might be: “Achieve a 2:1 reward-to-risk ratio over 20 trades with less than 10% drawdown.”

Then, revisit your strategy:

- Is your entry method still relevant?

- Are your risk management rules (like stop-loss size) too tight or too loose?

- Do your market conditions still align with your strategy type (trend-following, breakout, range)?

Remember: a trading plan isn’t meant to be static. It’s a living document that grows with your experience.

Step 3: Analyze Your Trading Journal

Your trading journal is your personal data goldmine. Review it thoroughly to find both strengths and weaknesses.

Ask these key questions:

- What setups or conditions lead to my best trades?

- What mistakes repeat most often (e.g., overtrading, FOMO, ignoring stop-loss)?

- How do my emotions affect my decision-making?

- Am I following my plan consistently?

Look for quantitative patterns (profit/loss ratio, average hold time, win rate) and qualitative patterns (confidence, patience, emotional triggers).

You can use spreadsheets or journaling tools like Edgewonk or TraderSync to make this process easier.

Step 4: Identify Mistakes and Patterns

After you’ve analyzed your journal, summarize the recurring issues. Examples include:

- Entering trades without confirmation signals.

- Exiting too early due to fear.

- Increasing lot size after a loss.

- Skipping trades when setups actually matched your plan.

Write them down. Awareness is the first step to improvement.

Then, group these issues into categories:

- Technical errors (wrong entry, poor analysis).

- Psychological errors (fear, greed, impatience).

- Strategic errors (misaligned setups, poor risk-reward).

From there, note what worked well. Reinforcing good habits is just as important as fixing bad ones.

Step 5: Update and Refine Your Plan

Now that you’ve gathered insights, it’s time to refine your plan. Adjust only one or two elements at a time—too many changes will make it hard to measure what’s actually working.

You might want to:

- Modify your entry/exit criteria to match the current market.

- Adjust your risk-to-reward ratio for better balance.

- Set new performance metrics (e.g., target monthly consistency instead of profit).

- Add psychological rules, such as taking a break after three consecutive losses.

End the review by updating your written plan document. Save the new version and compare it to the previous one next month. This creates a clear record of your evolution as a trader.

Common Mistakes Traders Make When Reviewing Their Plans

Even with the right intentions, many traders fall into traps during the review process. Here are some of the most common pitfalls:

- Being biased toward results.

Focusing only on profits can blind you to poor decision-making.

A winning trade doesn’t always mean a good trade. - Ignoring the emotional component.

Emotions drive most trading mistakes. If you don’t track how you feel, you’ll repeat the same patterns. - Changing strategies too often.

Constantly tweaking your plan after a few losses prevents long-term learning.

Give your system enough data to prove itself—at least 20–30 trades. - Not documenting changes.

Without notes, you can’t measure what’s improving.

Always record what you modify and why. - Skipping the review when things go well.

Many traders only review during losing streaks. But reviewing success helps you understand what works—and how to repeat it.

Turning Review into Consistent Improvement

Reviewing your trading plan isn’t just a formality. It’s a growth process.

Each session helps you become more self-aware, disciplined, and adaptable.

Here’s how to make it a consistent habit:

- Schedule It

Pick a specific day and time each week or month for your review. Treat it as seriously as a trading session. - Use a Checklist

A checklist ensures you don’t miss any critical elements. You can use the one below or create your own.Quick Trading Plan Review Checklist:

[ ] Did I follow my trading plan this week?

[ ] Which trades followed the rules perfectly?

[ ] What recurring mistakes did I notice?

[ ] Did I manage risk correctly in every trade?

[ ] How did my emotions affect my trades?

[ ] What adjustments will I make moving forward? - Track Your Progress

Maintain a Review Log separate from your trading journal. Each entry should summarize:- Key insights from the review

- Changes made

- Next review date

This helps you stay organized and measure your long-term improvement.

- Celebrate Small Wins

Don’t just focus on losses or problems. Acknowledge your progress—like sticking to your stop-loss rules or improving emotional control.

Small victories compound over time.

Example: Applying the Review Process

Let’s say you’re a swing trader who trades major forex pairs. You’ve been experiencing inconsistent results lately.

After reviewing your journal, you find:

- 70% of your losing trades happen on Mondays.

- You often enter trades based on anticipation rather than confirmation.

- You risk 2% per trade, but sometimes increase to 3–4% after a loss.

Action Steps from Your Review:

- Stop trading on Mondays and instead use that day for analysis.

- Add a new rule: only enter when the candle closes beyond a key level.

- Fix your maximum risk to 2% with no exceptions.

Within a month, your consistency improves—not necessarily because you changed your strategy, but because you fixed behavioral flaws.

Final Thoughts: Growth Through Reflection

The process of reviewing your trading plan is more than just a mechanical task. It’s self-coaching.

By reflecting on your performance, you build discipline, emotional control, and strategic awareness—qualities that separate amateurs from professionals.

Your trading plan should never collect dust. It’s a dynamic framework that evolves as you do. So, schedule your next review, open your journal, and start turning insights into action.

Each review is an opportunity—not to judge yourself, but to grow into a more confident, consistent trader.