Scroll through social media, and you’ll be bombarded with images of forex traders posing with rented Lamborghinis and promising overnight riches. Let’s get one thing straight: that’s not trading; it’s marketing. Your entry into the world’s largest financial market will be exciting, challenging, and, at times, frustrating. The first year isn’t about getting rich; it’s about staying in the game. Think of it as a marathon, not a sprint, where your endurance and discipline matter more than your initial speed.

This guide will give you a transparent, quarter-by-quarter breakdown of what to realistically expect from your first 12 months. We’ll navigate the crucial phases of learning, testing, and refining your approach. Forget the hype. The primary goal for your first year is not massive profit, but education, survival, and disciplined execution. Master these, and you’ll build a foundation for a long and potentially successful trading career.

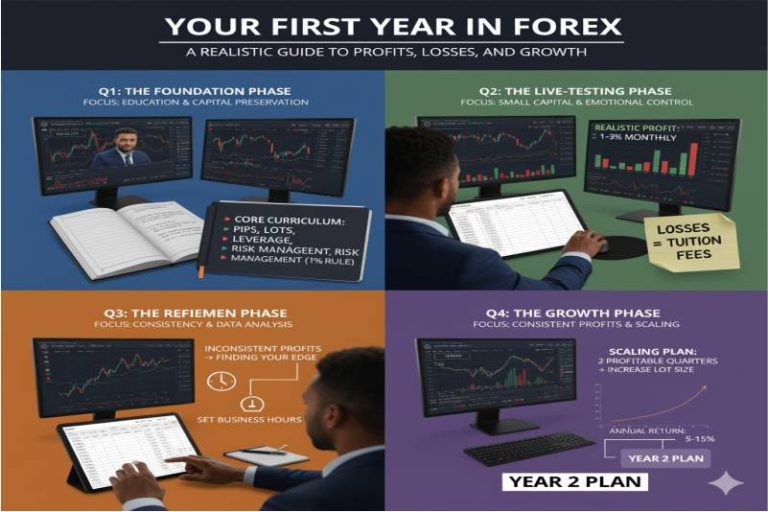

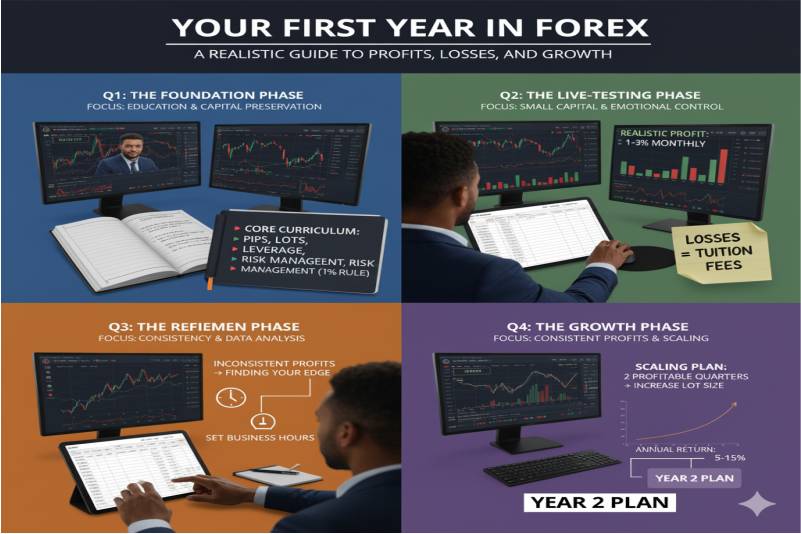

The Foundation Phase: The First Quarter (Months 1-3)

Your first three months are your apprenticeship. The singular focus here is on learning the mechanics and protecting your future capital. You wouldn’t perform surgery after watching a few YouTube videos, and you shouldn’t risk real money in the forex market without a solid educational foundation.

The Most Important Goal: Don’t Lose Money

Legendary investor Warren Buffett has two rules: “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” For a new trader, this translates to capital preservation. Before you can even think about making a profit, you must learn how to avoid catastrophic losses. This means understanding risk and accepting that your initial goal is to end this phase with your knowledge base expanded, not your bank account depleted.

Your New Classroom: Mastering the Demo Account

Your best friend during this quarter is the demo account. This is a simulated trading environment with virtual money that lets you experience the market without any financial risk. Spend at least one to three months here exclusively. Your mission is not to make a million virtual dollars but to practice the fundamentals: executing buy and sell orders, setting stop-losses and take-profits, testing a simple, clear strategy, and becoming intimately familiar with your trading platform’s interface.

Core Curriculum: What You Absolutely Must Learn

Focus your studies on the non-negotiable building blocks of forex trading. Don’t get lost in complex indicators or advanced theories yet. Master these first:

- Pips: The smallest unit of price movement and how you measure profits and losses.

- Lots: The size of your trade, which directly impacts your risk and potential reward.

- Leverage: A tool that allows you to control a large position with a small amount of capital—a double-edged sword that can magnify both gains and losses.

- Margin: The capital required to open and maintain a leveraged position.

- Risk Management: The most critical skill of all. Start with the 1% rule: never risk more than 1% of your account on a single trade.

Realistic Outcome for this Phase:

- Profit/Loss: You should expect to be unprofitable or, at best, at break-even on your demo account. Wild profitability here is often a sign of reckless trading that would be punished in a live market.

- Growth: Success is measured by the knowledge you’ve gained, your comfort with the trading platform, and your consistent application of your trading plan.

The Live-Testing Phase in First Years Forex: The Second Quarter (Months 4-6)

With a solid educational foundation, you’re ready to dip your toes into the live market. This phase is all about managing the intense psychology of trading with real money on the line.

Going Live: Why You Should Start with a Small Account

The moment real money is at stake, everything changes. Fear and greed, emotions that were absent in your demo account, will suddenly appear. That’s why you must start with a small, live account funded with capital you are genuinely prepared to lose. This isn’t your retirement fund or your future house deposit. This is your “market tuition” fund.

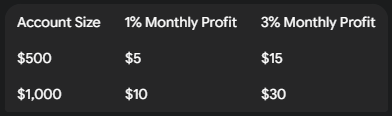

What is a “Realistic Profit” for a Beginner?

Let go of the dream of doubling your account overnight. For a beginner trader finding their footing, a realistic monthly profit target is between 1% and 3%. Even achieving a consistent break-even result is a massive victory at this stage. It proves you can navigate the market without blowing up your account.

Here’s what that looks like on a small account:

The numbers aren’t life-changing, but the skill you’re building is.

Expect and Analyze Your First Real Losses

You will have losing trades. You will have losing days. Accept this as a certainty. Frame these losses not as failures, but as tuition fees. Every loss is a data point that offers a lesson. This is where a trading journal becomes the most critical tool in your arsenal. Document every trade: your entry and exit points, your reasons for taking the trade, and, most importantly, your emotional state. This journal is the raw data that will fuel your future growth.

Realistic Outcome for this Phase:

- Profit/Loss: Expect to hover around break-even or incur small, manageable losses as you adapt to live conditions. Any small profit is an outstanding bonus.

- Growth: Your success is measured by a meticulously kept trading journal and your proven ability to stick to your trading plan despite the emotional pressures of fear and greed.

The Refinement Phase: The Third Quarter (Months 7-9)

You’ve survived the initial shock of live trading. Now it’s time to become a detective and use the data you’ve collected to build consistency and find your unique edge.

Using Your Journal to Find Your Edge

Your trading journal is a goldmine of information about your greatest opponent: yourself. Review it religiously. Look for patterns. Are you more profitable trading the London session than the New York session? Does the EUR/USD pair work better for you than the AUD/JPY? What is the single most common mistake you make—closing trades too early? Cutting winners and letting losers run? Your journal holds the answers. Identifying these patterns is the first step to refining your strategy and finding your personal trading edge.

Defining Your Trading “Business Hours”

The forex market is open 24 hours a day, five days a week, but you shouldn’t be. Treat trading like a professional endeavor, not a slot machine. Define your “business hours”—a specific 2-4 hour window each day where you will focus solely on the market. This prevents burnout, reduces emotional decisions, and forces you to only take the highest-quality trade setups according to your plan.

Shifting from Pips to Percentages

At this stage, you need to evolve your thinking. Stop obsessing over the dollar amount you win or lose. A $100 profit means very different things on a $500 account versus a $50,000 account. Start measuring your performance in percentages and risk-to-reward ratios. A successful week isn’t one where you made $50; it’s one where you risked 3% of your account and made a 6% return, achieving a 1:2 risk-to-reward ratio. This mindset is crucial for long-term scalability.

Realistic Outcome for this Phase:

- Profit/Loss: This is often the quarter where things start to click. You may experience your first consistently profitable month, though it will likely be interspersed with break-even or small losing months.

- Growth: Success is a refined, data-driven strategy and a much deeper understanding of your own psychological triggers and trading strengths.

The Growth Phase in First Year Forex: The Final Quarter (Months 10-12)

After nine months of diligent work, you are no longer a complete novice. This final quarter of your first year is about cementing good habits, aiming for consistency, and preparing to scale for year two.

What Consistent Profitability Actually Looks Like

Consistency in trading doesn’t mean you win every day or even every week. It’s about having a statistical edge that plays out over a large series of trades. A consistently profitable trader has profitable months that are larger than their losing months, resulting in a positive net outcome over the quarter and year. It’s about playing the long game with unwavering discipline.

The Plan for Scaling Up: When to Increase Your Lot Size

The temptation to dramatically increase your trade size after a few winning trades is a killer of new traders. Develop a strict, rule-based plan for scaling. For example: “After two consecutive profitable quarters where I have followed my plan with 90% accuracy, I will increase my risk-per-trade from 1% to 1.5%.” Scaling should be gradual and earned through proven consistency, not gambled on a hot streak.

Reviewing Your First Year Forex: A Trader’s Performance Review

As the year closes, conduct a thorough performance review. Go through your entire journal. What were your biggest wins and what did they have in common? What were your most painful losses and what lessons did they teach you? How has your strategy evolved from month one to month twelve? This objective self-assessment is vital for setting clear, intelligent goals for your second year.

Realistic Outcome for this Phase:

- Profit/Loss: Your goal is to achieve small, consistent monthly gains. A realistic and highly successful annual return for a disciplined first-year trader could be anywhere from 5% to 15%.

- Growth: You end the year with a data-proven trading strategy, disciplined habits that are becoming second nature, and a clear, professional plan for your future in the market.

FAQ: Answering Your Top Questions About Your First Year Forex

1. How much money do I need to start forex trading?

You only need an amount you are fully prepared to lose without it affecting your life. For many, this is between $100 and $1,000. The focus is on learning the process, not the dollar amount.

2. Can I make a living from forex in my first year?

Almost certainly not. The first year is for education and skill-building. Attempting to live off your trading profits prematurely creates immense psychological pressure that leads to poor decisions and blown accounts.

3. What is the number one mistake new forex traders make?

Poor risk management. This includes risking too much per trade, not using a stop-loss, and moving a stop-loss to accommodate a losing position. Mastering risk is more important than finding the perfect entry signal.

4. How long does it really take to become consistently profitable in forex?

This varies, but for most dedicated traders, it takes at least two to three years of focused effort. Your first year is about building the foundation for that future success.

Conclusion: Your Journey from Novice to Trader in First Year Forex

Your first year in forex is a rite of passage. It will test your patience, your discipline, and your resolve. By shedding the get-rich-quick mentality and adopting the mindset of a student, you transform the market from a casino into a professional arena. You’ve learned that survival is the first victory, that losses are lessons, and that true growth is measured in discipline, not dollars.

The hard work you’ve put in—the journaling, the analysis, the emotional control—has built a robust foundation. You are no longer just someone who clicks buttons; you are a trader with a plan. Your journey is just beginning, but you’re now equipped to walk the path with realism and resilience.

What was the biggest lesson from your first year of trading? Share your experience in the comments below!